>> Lorien: For instance, crash as well as comprehensive you can really pick different deductibles for those 2 protections depending on what works best for you. insurance affordable. >> Lorien: So at the end of the day if you have any kind of concerns regarding deductibles, all you need to do is call your agent, they'll be able to help you.

car insurance prices car cheapest car

car insurance prices car cheapest car

Insurance terminology can be perplexing at times, with all its various nuances as well as particular terms. You need to consider this decision very carefully because it affects the cost of your insurance coverage and also your protection in the event of a claim.

Just what is an insurance deductible? A deductible is the quantity that you are responsible for paying in case of a claim. It relates to any insurance coverage and also differs relying on the contract. This might appear quite easy externally, yet it's not something you must ignore. vehicle insurance.

Basically, the greater your deductible, the reduced your insurance costs, and also vice versa. If you do file a case you will have to pay the quantity of your insurance deductible. You get itif there were no deductibles, insurance costs would certainly be greater.

Let's take an instance: you make a case and also the cost to repair your car is $3,000. If your insurance deductible is $500, you pay $500 as well as your insurer pays $2,500 as your advantage to cover the difference (low cost). On the other hand, if you don't make any insurance claims for a number of years, you might save greater than the quantity of the insurance deductible that you would need to pay if you had a mishap.

If so, a greater deductible is a proven method to save money on your insurance premium. Don't forget, mishaps DO occur! And if one does, you'll have to pay immediately. Who do I pay my deductible to in the event of a case? Virtually talking, the insurance deductible is removed the settlement set with your insurance company when you make an insurance claim.

Car Insurance Deductibles Guide: 5 Key Things To Know In 2022 for Dummies

Whether you're a brand-new vehicle driver or have actually lagged the wheel for many years, it can be daunting to wade via insurance coverage terms like "insurance deductible." Your vehicle insurance deductible influences the expense of your insurance, so it's essential that you select one thoroughly. The deductible that's right for you depends upon your private situations.

If you require to sue with your auto insurance policy company after a crash, or when your automobile is otherwise harmed, there's a likelihood you'll require to pay a deductible - cars. Exactly how does a deductible job? An insurance deductible is the quantity of money you pay out of pocket prior to your insurance policy protection kicks in as well as starts spending for the expenses of your loss.

Not all insurance coverage coverages require an insurance deductible, however if yours does, you'll select the amount. Your deductible will certainly influence your monthly insurance policy payment the reduced your insurance deductible, the higher your cars and truck insurance policy premium.

Auto insurance coverage plans can include various types of insurance coverage that serve differing objectives, and you can choose to be covered by some or all of them. State legislation typically establishes whether or not an insurance deductible is needed.

This covers you if your vehicle hits an additional lorry or object as well as you need to spend for repair services. Collision deductibles are basic but differ by insurance firm. affordable auto insurance. If your car is damaged by an event such as fire, a falling object striking your windshield or vandalism, you'll file a comprehensive insurance coverage insurance policy case.

Deductibles are sometimes needed for this insurance coverage, but not constantly, as well as demands vary by state. While your vehicle insurance coverage deductible can differ significantly depending on many elements, consisting of just how much you want to pay, automobile insurance policy deductibles normally vary from $100 to $2,500.

What Is A Car Insurance Deductible? - Bankrate Fundamentals Explained

When picking a deductible, you'll require to take into consideration several elements, including your budget plan. Spend some time determining exactly how much you can pay for to pay for an insurance deductible as well as exactly how much you'll reduce your regular monthly costs by deciding for a greater one. Ask yourself these inquiries when selecting a deductible amount.

If you obtain in a crash, can you manage the deductible or would you battle to pay it? Taking on a high insurance deductible might not make much sense if it represents a huge section of the cars and truck's worth.

liability vans accident insure

liability vans accident insure

They likewise commonly ask yourself why so much consideration is offered to the deductible quantity.

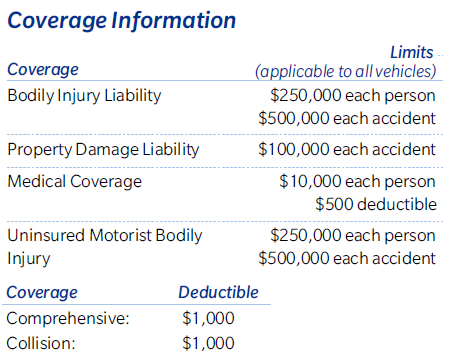

While there is no insurance deductible on obligation insurance policy, your coverage prolongs only to the restriction of your policy (low-cost auto insurance). If an uninsured vehicle driver strikes your automobile, or you are struck by a motorist with not enough liability insurance policy for home damage, this kind of coverage will certainly pay the fixing costs or make up the difference up to your protection limit after the deductible is paid.

If you opt for a lower insurance deductible, state $250, you will certainly pay $250 of that same $499 costs. With an even lower insurance deductible, at $100, the insurance policy firm pays $399. If you were not at mistake, the other chauffeur's insurance business should pay your repair work expenses, up to the restrictions of the plan.

Determine what you would certainly pay for a $1,000 deductible, a $750 insurance deductible, as well as a $500 insurance deductible. Identify your financial savings with eachwith the understanding that you do not recognize whether you'll have an accident during the yearand opt for the quantity supplying one of the most cost savings with the defense you want. Conserve money on your premiums by choosing high insurance deductible automobile insurance policy.

The Only Guide for Types Of Deductible In Car Insurance - Digit

Evaluate the benefits and drawbacks of a high versus a low insurance deductible by figuring out just how much you can pay for to pay in a worst-case situation. liability. If you have the methods to pay even more expense without seriously impacting your way of living, choosing a high deductible could be the best way to go.

Constantly call the police after a car crash, also if it seems no one was harmed and there was little damage. Stopping working to report a mishap and after that finding the damages is even worse than you thought indicates the insurance business might not pay your claim.

The insurer approximates repair expenses. The repair work shop submits a report concerning the cost of repair work and also the insurance coverage firm must accept it.

, we comprehend that car insurance can be complicated. Choices concerning what coverage and also insurance deductible are best for you can appear frustrating, but our group is right here to answer any type of inquiries you have to aid you choose the best policy for your special scenario.

You'll likewise have to choose your insurance coverage deductible, which can be much more challenging than it sounds. insured car. To select the appropriate insurance deductible for you, you'll need to consider your driving history, your emergency situation fund, and also the costs of different deductibles, along with a number of various other aspects.

Secret Takeaways Your insurance deductible is the portion of expenses you'll pay for a covered case. Evaluate your vehicle's value, your emergency fund, and the costs of insurance coverage when selecting an insurance deductible. Selecting a higher deductible may help you conserve cash on premiums, however this suggests you'll need to pay even more out of pocket after an accident.

Unknown Facts About What Should My Insurance Deductible Be?

In some states, you might likewise have a deductible for:: Pays to fix your vehicle after damages triggered by a chauffeur without insurance or without sufficient coverage.: Pays your clinical costs when you have actually been injured in an accident.: Covers the costs of some mechanical repairs, similar to a service warranty (low cost).

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg) insurance car low cost auto insurance

insurance car low cost auto insurance

Whether you pay an insurance deductible after an event relies on your insurance coverage, who is at fault, your insurance provider, as well as your state's regulations. In California, you could certify for a deductible waiver on your crash protection, which implies your insurance provider will certainly pay the insurance deductible if a without insurance vehicle driver hits you.

Just how Does a Deductible Job? Imagine a tree branch falls on your automobile and causes damages. You sue on your comprehensive coverage and the service center approximates it will certainly set you back $1,000 to repair. What you'll pay relies on your deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the expense of repairing the damages is the same or virtually the same as your deductible, you might pick not to submit a claim since you 'd shed any kind of claim-free discount.

When Do You Pay a Deductible? You'll usually pay your deductible straight to the car service center after they complete the repair services. The insurance company will certainly subtract your portion from the total amount they send to the service center. In the circumstance above, with a $500 insurance deductible, the insurance business would certainly pay the auto repair work shop $500, as well as you 'd be anticipated to pay the various other $500.

As the vehicle's value boils down, the chance of a failure goes upmeaning it might not be worth buying optional protections. For instance, the Kansas Insurance Division recommends lugging just liability coverage on autos worth less than $3,000. Due to a present scarcity of previously owned cars, Mc, New bride pointed out that you could likewise intend to consider how essential your auto is as a method of transport.

Other Questions to Ask When Picking Deductibles While the 3 variables above are the most critical when picking an Visit website insurance deductible, you'll want to ask these concerns, also. Numerous coverage deductibles start at $250 or $500, but some insurance firms supply a $0 deductible alternative for specific insurance coverages, and also others may need higher-risk chauffeurs to bring greater deductibles - affordable auto insurance.

The Best Guide To What Does Deductible Mean In Car Insurance?

Can You Make Use Of Other Insurance Coverage to Cover the Costs of Injuries? In some states, you might be able to utilize wellness coverage to pay the costs of injuries because of car mishaps rather of counting on vehicle insurance coverage, such as clinical repayments or PIP insurance. In this situation, you could choose a higher deductible or a lower restriction on those coverages, which would save you money - prices.