Your vehicle insurance deductible is your duty and also has to be paid prior to your insurance carrier covers the remainder. As a consumer, you can typically select a higher insurance deductible and also score a reduced vehicle insurance costs.

If any kind of damages or repairs are much less than the expense of your insurance deductible, after that it's not worth submitting a case. On the other hand, if you select a reduced car insurance coverage deductible in between $100 as well as $500, the likelihood of you suing rises. That implies you'll likely pay a higher monthly premium and also be considered even more of a threat to your insurance carrier.

insurance company cheapest car insurance vans cars

insurance company cheapest car insurance vans cars

When do you pay the deductible for auto insurance? You do not have to pay your cars and truck insurance deductible when choosing an automobile insurance plan. Rather, you pay your auto insurance costs. You have to pay your vehicle insurance policy deductible when you make an insurance claim. The car insurance deductible can be payable to either your service center or your insurance policy company, depending on the quantity, your plan, and your supplier's general insurance deductible policy.

Bear in mind, eventually, paying your deductible is up to you. If you would rather not send a case, you don't have to pay your deductible, yet you will certainly be accountable for the whole cost of your repair. What are the various types of automobile insurance policy deductibles? When you choose an auto insurance coverage plan, you sign up for a certain sort of coverage that can aid out in certain situations.

The Best Strategy To Use For What Are Auto Insurance Deductibles & How Do They Work?

If your car gets harmed in a fanatic hailstorm or hit by a deer, or ends up being stolen, detailed insurance coverage will come to the rescue. This type of protection is typically offered in tandem with crash insurance policy.

This kind of protection helps cover the price of repair work or any type of needed substitutes if there's an event. In the event you get into an accident with an uninsured driver or one with limited protection, this type of insurance policy can help cover expenses.

This might not be offered in every state or by every insurance policy supplier.

If you select a reduced auto insurance coverage deductible amount, it's most likely your costs will certainly be higher. While you're paying a lot more now, if something occurs down the line and you enter into a mishap, you'll pay much less out-of-pocket after that. Your deductible amount should be something you really feel comfy paying or have simple access to in a reserve, or as a last hope, a credit line. credit.

Facts About Deductibles 101 - Tips & Resources - Grange Insurance Revealed

If you opt for liability-only that covers damage and also injury costs for the other chauffeur if you're at fault - car. On the other hand, detailed as well as collision insurance policy can cover mishaps, burglary, and also climate occasions that can appear of nowhere. You can pick the deductible amount for each and every sort of protection, so if you assume you are a secure motorist, it might make sense to have a greater crash insurance deductible (where you can typically avoid a crash) versus comprehensive (where the occasions are generally out of our control).

insurers cheaper car credit score cheaper auto insurance

insurers cheaper car credit score cheaper auto insurance

That indicates considering your danger levels, demands, finances, and also extra. You additionally intend to make certain you have the ideal insurance coverage to protect on your own in different circumstances (car insurance). And if you don't drive quite? You can pay less with pay-per-mile vehicle insurance with Metromile. If you're still paying for miles you aren't driving, it's time to reconsider your vehicle insurance policy coverage.

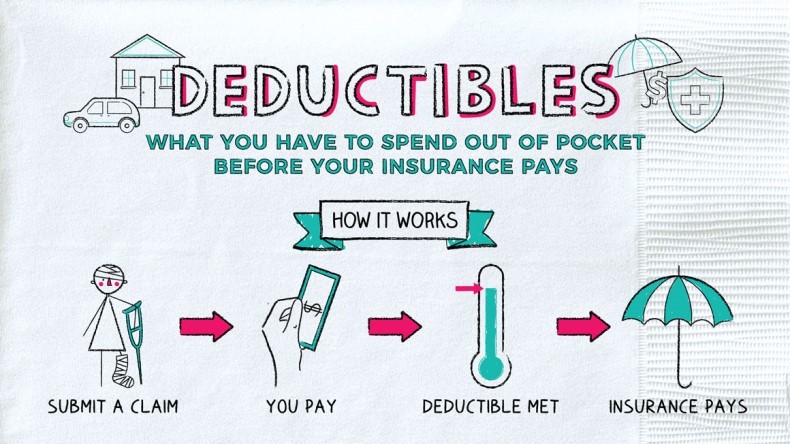

An auto insurance policy deductible is the amount an insurance holder is accountable for paying when making a case with their cars and truck insurance company after a covered occurrence. This needs to take place prior to insurance coverage pays the costs of problems. If a car sustains $5,000 worth of damage in a covered accident and also the vehicle driver has a $1,000 insurance deductible, they would pay $1,000 of the repair service prices as well as the insurance provider would certainly pay $4,000.

cheaper car cheapest car auto insurance car insurance

cheaper car cheapest car auto insurance car insurance

The driver would just pay their deductible. When you don't have to pay an auto insurance coverage deductible, There are particular circumstances when individuals do not have to pay an automobile insurance coverage deductible. If an additional motorist triggers a collision and also their insurance policy pays In the majority of states, a driver who is in charge of triggering an accident is bound to spend for all problems related to the collision.

Facts About Car Insurance Deductibles Explained - Forbes Uncovered

cheap car car cars cheap auto insurance

cheap car car cars cheap auto insurance

If someone's own lorry is additionally damaged in the same occurrence and also they want to make a claim for repair services under their accident protection, their deductible will apply. If the particular kind of damages does not need paying a deductible Sometimes, certain losses are covered without a deductible.

If somebody went with no deductible when buying insurance coverage Insurance providers may enable people to select insurance coverage with a $0 insurance deductible. If a person has no deductible, they won't owe anything expense when a covered incident takes place. Bear in mind, though, the rate of car insurance coverage will be greater if someone selected a no-deductible policy.

Commonly, drivers require to choose a deductible for extensive coverage, accident protection, and also accident protection. What's the average automobile insurance deductible? The ordinary vehicle insurance policy deductible is $500. Individuals can select a deductible amount anywhere from $0 to $2,000 with a lot of insurance companies. Just how much of a deductible should I pick for my vehicle insurance coverage? The objective when obtaining an vehicle insurance coverage quote is to obtain high quality as well as budget friendly insurance policy - insurance companies.

Here are some essential factors to consider. Risk tolerance, When choosing a policy with a greater deductible, people take a bigger risk. They're wagering that they will not require to make an insurance claim as well as pay out-of-pocket expenditures. Those that aren't comfy taking that possibility might want to pay higher premiums to pass even more of the danger of economic loss on to their insurance coverage carrier. credit.

5 Easy Facts About What Is A Deductible? - Njm Shown

Those that often tend to have little money saved for unexpected expenditures might desire to choose a lower insurance deductible. suvs. Individuals with a large emergency situation fund can probably afford to gamble of incurring higher out-of-pocket costs if they make an insurance case. The possibility of a claim, The a lot more likely it is somebody will make an insurance claim, the lower they should establish their insurance deductible.

If the possibilities of a protected case are unlikely, a vehicle driver may be much better off maintaining their premiums low. Some people might conserve around $220 annually on comprehensive as well as accident protection by switching over from a plan with a $50 insurance deductible to one with a $250 deductible. By placing the costs financial savings right into a bank account, a person might have adequate cash in around a year to cover the added deductible amount (cheap).

As long as a driver doesn't enter into a mishap in less than a year, they would certainly be better off. The worth of the vehicle, If a vehicle isn't worth a lot, it might not pay to have insurance coverage with a high insurance deductible. Claim a motorist chooses accident insurance coverage with a $1,000 deductible as well as their car is just worth $1,000.

In this situation, the motorist would be much better off giving up crash insurance coverage totally. Exactly how to avoid paying a car insurance deductible, The best way to stay clear of paying an automobile insurance policy deductible is to prevent accidents, theft, or damage. Technique defensive driving, follow the regulations of the road, comply with the speed limit, and also avoid driving in negative weather.

Some Known Details About Who Pays The Deductible In A Michigan Car Accident?

People can additionally select a policy without any deductible, albeit at a greater cost. Or they can register for a vanishing or going away insurance deductible with insurance providers that use it. This will certainly reduce the quantity of the deductible by a collection quantity throughout each time period the vehicle driver is without mishaps.

Insurance deductible specified A deductible is a quantity of money that you on your own are accountable for paying towards an insured loss. When a calamity strikes your residence or you have an automobile crash, the amount of the insurance deductible is deducted, or "subtracted," from your case payment. Deductibles are the method which a danger is shared between you, the insurance holder, and also your insurance firm.

A deductible can be either a certain dollar amount or a percent of the overall amount of insurance policy on a policy - cars. The amount is developed by the terms of your protection You can find out more and can be discovered on the declarations (or front) page of standard home owners and vehicle insurance plans. State insurance guidelines purely determine the method deductibles are incorporated into the language of a policy as well as exactly how deductibles are applied, and also these legislations can vary from state to state.

In case of the $10,000 insurance loss, you would be paid $8,000. In the occasion of a $25,000 loss, your claim check would certainly be $23,000. Keep in mind that with auto insurance coverage or a homeowners plan, the insurance deductible uses each time you sue. The one significant exemption to this remains in Florida, where typhoon deductibles specifically are used per period instead of for each and every storm (insured car).

What Is A Car Insurance Deductible? - Credit Karma Things To Know Before You Get This

To utilize a a property owners plan instance, an insurance deductible would apply to residential or commercial property damaged in a rogue outside grill fire, however there would be no deductible against the obligation part of the policy if a shed guest made a medical insurance claim or taken legal action against. dui. Raising your deductible can save cash One means to save money on a house owners or car insurance policy is to increase the deductible so, if you're looking for insurance coverage, ask regarding the options for deductibles when comparing policies.

Mosting likely to a $1,000 insurance deductible may conserve you even extra. A lot of house owners as well as occupants insurers offer a minimum $500 or $1,000 insurance deductible. Raising the deductible to greater than $1,000 can reduce the price of the policy - credit. Certainly, keep in mind that in case of loss you'll be in charge of the deductible, so make certain that you fit with the quantity.

In some states, insurance policy holders have the option of paying a greater costs in return for a conventional buck insurance deductible; nonetheless, in risky seaside areas insurance firms may make the percent insurance deductible mandatory. operate in a comparable means to typhoon deductibles and also are most usual in locations that commonly experience severe windstorms as well as hailstorm. cars.

Wind/hail deductibles are most typically paid in percents, typically from one to 5 percent. You can select one insurance deductible for your home's structure and also one more for its materials (note that your home mortgage business might need that your flood insurance coverage deductible be under a certain amount, to assist guarantee you'll be able to pay it).

The 8-Second Trick For Coverages - Auto-owners Insurance

Insurance companies in states that have greater than ordinary danger of earthquakes (for instance, Washington, Nevada as well as Utah), often set minimal deductibles at around 10 percent - automobile. In California, the basic The golden state Quake Authority (CEA) plan consists of an insurance deductible that is 15 percent of the replacement price of the primary house framework as well as starting at 10 percent for extra protections (such as on a garage or other outhouses).

What is an insurance deductible? An insurance deductible is what you pay out of pocket to fix your cars and truck before your car insurance coverage spends for the rest. Exactly how does an insurance deductible work? If you carry comprehensive and also crash coverage on your cars and truck insurance policy, you will see an insurance deductible detailed on your policy as a buck amount.